- Oct 21th, 2020

- 1 min read

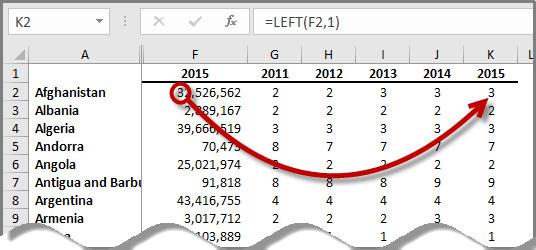

Financial Reporting: Using Bedford's Law to Detect Fraud

Fraud detection is a very important issue in all industries including the world of investments. There are various methods to detect fraud and applying Benford’s Law is one of them. Benford’s Law states that in real-life sets of numerical data that the first digit should be a one 30.1% of the time, a two 17.6% of the time and so on with a 9 occurring 4.6% of the time. When the returns of Madoff were analyzed, it was discovered that they started with a one 39.6% of the time when it was expected only 30.1% of the time, a large red flag for possible fraud. This analysis is fairly easy to apply and can be done in Excel. There is a link below on how to do that.

Read more about Bedford's law ...- Oct 20th, 2020

- 3 min read

Use Case: Historic P&L Analysis

Clarity Analytics was hired by a predominant prop trading firm to analyse a handful of accounts and produce historic P&L and margin requirements over the last 6 years. The joint venture between Senex solutions’ accounting platform and XonaSoftware’s low-code automation made this possible.

Read full article ...